GUIDE FOR CREDITORS PURSUING CLAIMS AGAINST A BANKRUPT COMPANY UNDER THE INSOLVENCY AND BANKRUPTCY CODE (IBC)

This guide outlines the legal framework, procedural steps, and strategic considerations for creditors seeking to recover dues from a bankrupt company in India under the Insolvency and Bankruptcy Code (IBC), 2016. The IBC prioritizes creditor rights and streamlines insolvency resolution through a time-bound process.

OVERVIEW OF THE IBC FRAMEWORK

The IBC aims to resolve insolvency in a creditor-friendly manner by:

1. Providing a structured mechanism for debt recovery.

2. Ensuring fair distribution of assets in liquidation.

3. Promoting revival of distressed companies through resolution plans.

4. Imposing strict timelines (max 180+90 days for CIRP).

Key Authorities Involved:

• National Company Law Tribunal (NCLT): Admits insolvency petitions and oversees proceedings.

• Insolvency Resolution Professional (IRP): Manages the Corporate Insolvency Resolution Process (CIRP).

• Committee of Creditors (CoC): Decides the fate of the company (resolution or liquidation).

• Insolvency and Bankruptcy Board of India (IBBI): Regulates IRPs and ensures compliance.

KEY STEPS FOR CREDITORS TO INITIATE AND NAVIGATE THE CIRP

1. Pre-Petition Requirements

a. Demand Notice (Section 8 of IBC):

• Who Can Send? Financial creditors (e.g., banks, NBFCs) must issue a demand notice to the corporate debtor. Operational creditors (e.g., suppliers) must send a demand notice and a copy of an unpaid invoice.

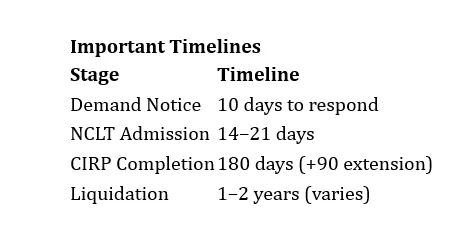

• Content: Clearly state the default amount, details of the debt, and demand repayment within 10 days.

• Proof: Retain evidence of delivery (e.g., registered post, email acknowledgment).

b. Filing the Insolvency Petition (Section 7/9 of IBC):

• Threshold: Financial creditors require a default of ₹1 crore or more (reduced from ₹2 crore in 2020). Operational creditors must prove default and lack of dispute.

• Documents Required:

‣ Proof of debt (loan agreements, invoices, ledgers).

‣ Evidence of default (bank statements, bounced checks).

‣ Copy of demand notice and proof of delivery.

2. Admission of Petition by NCLT

• Timeline: NCLT must decide on admission within 14 days (extendable to 21 days).

• Outcomes:

‣ If admitted:

⁃ Moratorium is imposed (no legal actions against the company).

⁃ IRP is appointed to take over management.

‣ If rejected: Creditor may appeal to NCLAT.

Critical Tip: Ensure all documentation is airtight to avoid dismissal. Engage legal counsel to draft the petition.

3. Corporate Insolvency Resolution Process (CIRP)

a. Role of the IRP

• Public Announcement: IRP invites claims from all creditors within 14 days.

• Verification of Claims: Creditors must submit claims with proof (e.g., loan agreements, invoices).

• Constitution of CoC:

⁃ Only financial creditors are part of the CoC.

⁃ Voting share is proportional to the debt amount.

b. Strategic Participation in the CoC

• Voting Rights: Secured creditors (e.g., banks) hold majority voting power. Operational creditors are not part of CoC but can attend meetings.

• Key Decisions:

‣ Approval of resolution plans (requires 66% majority).

‣ Replacement of IRP.

‣ Extension of CIRP timeline.

Actionable Advice:

• Collaborate with other creditors to form a voting bloc. • Scrutinize resolution plans for feasibility and fairness.

c. Resolution Plan Submission

• Timeline: Resolution plans must be submitted within 180 days (extendable by 90 days).

• Evaluation Criteria:

‣ Maximizes value for creditors.

‣ Ensures company revival.

‣ Complies with IBC regulations (e.g., no haircuts for operational creditors below liquidation value).

Note: If no plan is approved, NCLT orders liquidation.

4. Liquidation Process

If resolution fails, the company enters liquidation:

1. Liquidator Appointment: The IRP typically becomes the liquidator.

2. Asset Realization:

‣ Secured creditors can enforce security interests or relinquish them to the liquidator for liquidation proceeds.

3. Priority of Payments (Section 53 of IBC):

• Order:

‣ Insolvency resolution and liquidation costs.

‣ Secured creditors (if they relinquish security).

‣ Employee wages (up to 24 months).

‣ Unsecured financial creditors.

‣ Government dues. Shareholders.

Key Insight: Secured creditors recover first, but operational creditors often face lower recovery rates.

STRATEGIC CONSIDERATIONS FOR CREDITORS

1. Avoidable Transactions (Sections 43–66 of IBC)

Creditors can challenge:

• Preferential Transactions: Payments favoring specific creditors within 1 year of insolvency.

• Undervalued Transactions: Asset transfers below market value.

• Fraudulent Transactions: Intentional asset diversion.

Action: File applications with NCLT to claw back such transactions.

2. Monitoring the Process

• Attend CoC meetings regularly.

• Demand transparency from the IRP on asset valuations and resolution plans.

3. Legal Recourse

• Appeal adverse NCLT decisions to the National Company Law Appellate Tribunal (NCLAT).

• Report IRP misconduct to the IBBI.

Challenges and Solutions

Delays in NCLT Proceedings: File interlocutory applications to expedite hearings.

Low Recovery in Liquidation: Prioritize resolution over liquidation by supporting viable plans.

Operational Creditor Exclusion: Negotiate with CoC to ensure fair treatment in resolution plans.

CONCLUSION

The IBC empowers creditors to recover dues efficiently, but success requires:

Proactive Participation: Engage in CoC decisions and monitor IRP actions.

Documentation: Maintain meticulous records of debt and default.

Legal Expertise: Partner with insolvency professionals to navigate complexities.

By leveraging the IBC’s provisions, creditors can maximize recoveries while contributing to India’s evolving insolvency ecosystem.

Key Resources:

• Insolvency and Bankruptcy Code, 2016.

• IBBI Regulations.

• NCLT/NCLAT Case Law Database.

Sign up for my newsletter