Section 43B(h) does not apply to Traders

Introduction:

The Finance Act of 2023 introduced a pivotal amendment to Section 43B(h) of the Income Tax Act, 1961, reshaping the landscape of delayed payments and benefits for businesses falling under the Micro, Small, and Medium Enterprises Development Act, 2006 (MSMED Act). This amendment holds particular significance for Wholesale and Retail Traders, altering the dynamics of payment timelines and tax deductions.

Changes in MSME Definition:

Before delving into the implications of the amendment, it is crucial to understand the changes in the definition of MSMEs. Prior to July 2, 2021, retail and wholesale traders were not included in the MSME definition. However, an Office Memorandum issued on July 2, 2021, expanded the scope of MSMEs to include certain categories related to retail and wholesale trade activities.

The following NIC codes were included in the list of eligible categories for Udyam Registration:

1. 45 - Wholesale and retail trade and repair of motor vehicle and motorcycles

2. 46 - Wholesale trade except for motor vehicles and motorcycles

3. 47 - Retail Trade except for Motor Vehicles and motorcycles

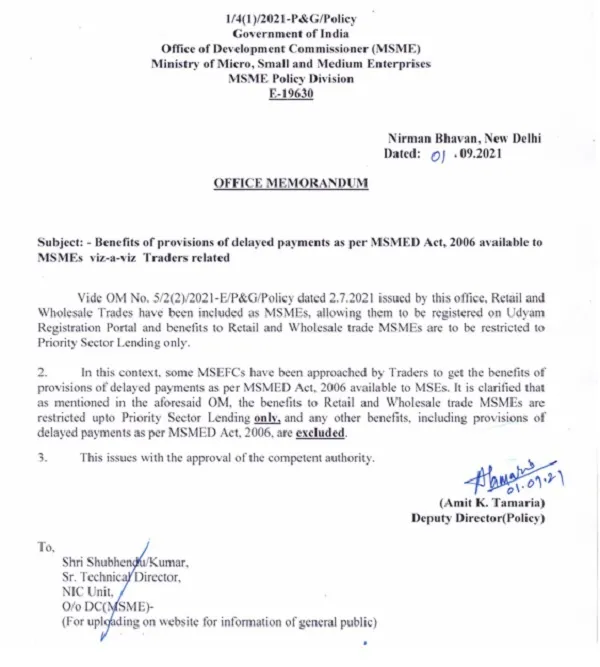

Additionally, the Office Memorandum (OM) No. 1/4(1)/2021-P&G/Policy, Dated: 01.09.2021 clarified that benefits for Retail and Wholesale trade MSMEs are restricted to Priority Sector Lending, excluding other benefits, including provisions related to delayed payments under the MSMED Act, 2006.

Amendment to Section 43B(h):

The crux of the amendment lies in Section 43B(h), where the Finance Act, 2023, broadened its scope to cover delayed payments to Micro or Small Enterprises. If payments are delayed beyond the time limits specified in Section 15 of the MSMED Act, 2006 (15 or 45 days, as applicable), the disallowance of the deduction for the previous year in which the liability was incurred is enforced. Deduction is only allowed in the previous year in which the actual payment is made, excluding benefits up to the due date of filing the Income Tax Return.

Implications for Wholesale and Retail Traders:

Upon careful analysis, it is evident that the amendment in Section 43B(h) applies to entities other than Retail and Wholesale Traders. As per the Office Memorandum issued on September 1, 2021, Retail and Wholesale Traders are excluded from the purview of Section 43B(h). This implies that there will be no disallowance on account of delayed payments beyond 15 or 45 days for these traders.

The categorization selected while applying for MSME status plays a crucial role in determining whether a supplier falls under the Retail and Wholesale Trader category. It is imperative for businesses to align their categorization accurately for compliance and strategic decision-making.

Conclusion:

In conclusion, the nuanced changes in Section 43B(h) of the Income Tax Act, 1961, brought about by the Finance Act, 2023, have distinct implications for the Wholesale and Retail Trade sectors. Understanding the categorization under MSME, coupled with precise timelines for payment, becomes paramount for businesses navigating these amendments. Thorough verification against the presented facts, including the Office Memorandum issued on September 1, 2021, is essential for accurate compliance and informed decision-making in the dynamic landscape of tax regulations. Businesses must stay vigilant and adapt their strategies to ensure seamless compliance with the evolving legal framework.

Sign up for my newsletter