Tax Implications of Immovable Property Sales: Sec 50C vs. Sec 43CA

Introduction:

Understanding the tax implications of real estate transactions is pivotal for professionals in the financial and taxation domain. The distinction between a "capital asset" and "stock in trade" plays a crucial role in determining the applicable provisions of the Income Tax Act. This article aims to elucidate the complexities surrounding the sale of immovable property, specifically land and buildings, under Section 50C and Section 43CA.

Definition of Capital Asset:

Before delving into the intricacies of Sections 50C and 43CA, it is essential to comprehend the definition of a "capital asset." As per the Income Tax Act, a capital asset encompasses property of any kind, excluding stock in trade, consumable stores, or raw materials used for business or profession purposes. The term "business" includes trade, commerce, manufacture, or any adventure or concern in the nature of trade, commerce, or manufacture.

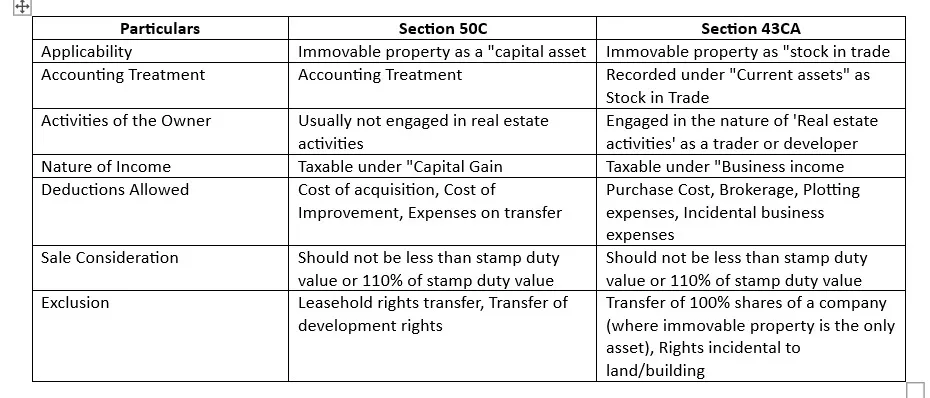

Tabulated Summary of Sec 50C & Sec 43CA:

Important Judgments:

1.Kan Construction & Colonizers (P) Ltd. (70 DTR 169) - Allahabad HC:

The High Court held that if the asset is held as stock in trade, the profits and gains from the sale are liable to be taxed as profits and gains from business and not as capital gains. Section 50C has no application where the transfer of immovable property is on account of the sale of stock.

2. Commissioner Of Income Tax I vs M/S.Thiruvengadam Investments - Decided on 1 December 2009:

The Tribunal concluded that invocation of Section 50C is not warranted if the property is treated as a business asset, not a capital asset, and is shown under the head 'loans and advances' in the balance sheet.

3. Interlok Hotels (P) Ltd Vs. ITO:

The Assessing Officer cannot reject the assesse's contention unless defects in the books of account or unreliability of accounts are found. Section 50C is not applicable when income is computed under the head "Profits & Gains under business or Profession."

Conclusion:

Navigating through the complexities of Sections 50C and 43CA is essential for tax professionals dealing with real estate transactions. Distinguishing between a capital asset and stock in trade is pivotal in ensuring accurate tax reporting and compliance. The judgments mentioned provide insights into the application of these sections in specific scenarios, aiding professionals in making informed decisions for their clients. Understanding these provisions is crucial for ensuring optimal tax outcomes and compliance with the ever-evolving landscape of real estate taxation in India.

Sign up for my newsletter